We are committed to providing you with holistic, objective, and creative solutions to the maze of financial challenges that you may face throughout your life. Pathway Financial Design is unique in the fact that we provide institutional-quality financial advice coupled with the intimacy of a privately-held boutique firm. It is our steadfast goal to develop and maintain a long-term relationship with your entire extended family and to be a valued resource for your business or professional practice.

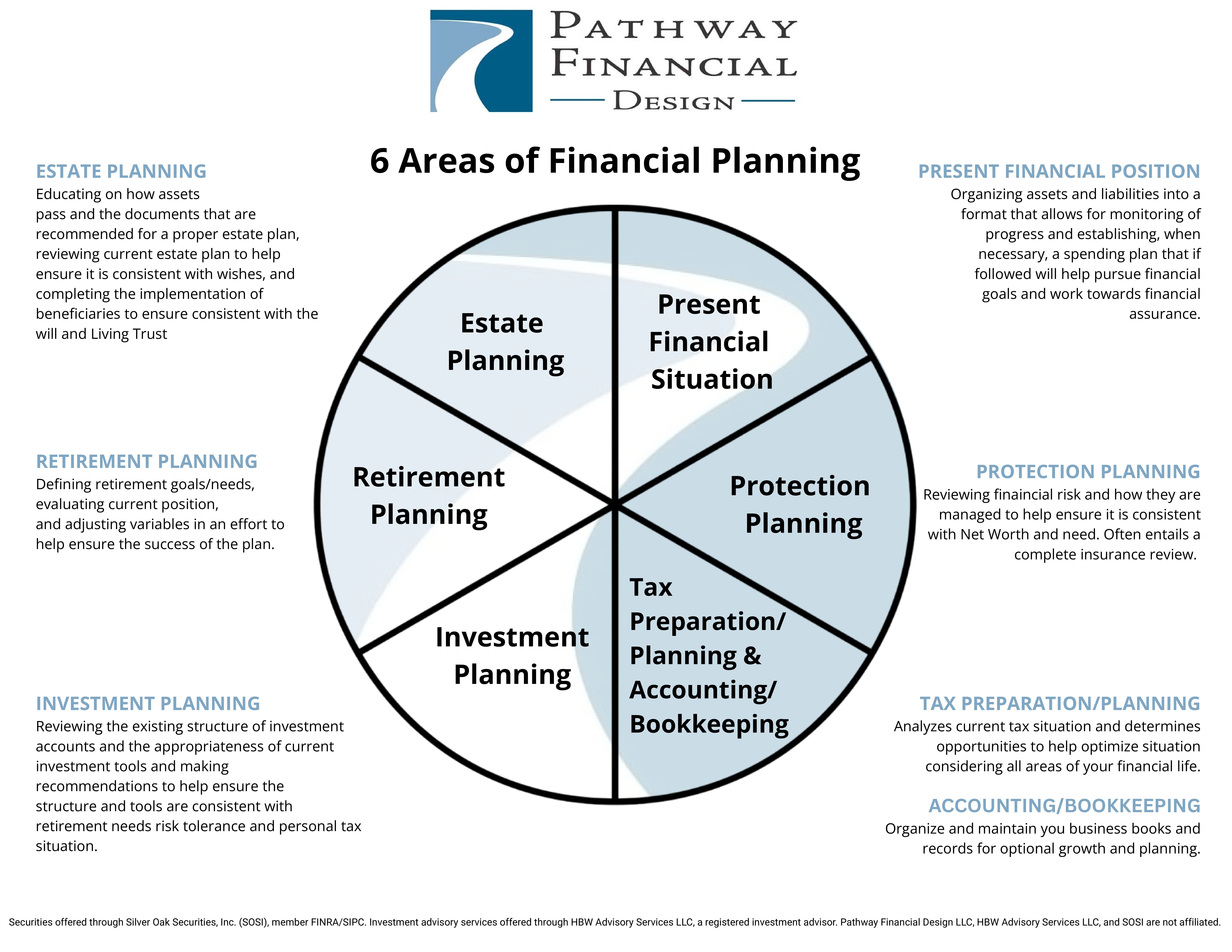

In order to help deliver the best outcomes, we offer a full menu of financial services under one roof. For many busy families and small business owners, financial planning can seem very time consuming and often overwhelming. We help you simplify and organize your financial lives by collaborating with you and addressing your needs. First, we document your short- and long-term goals. Then, we develop a comprehensive and personalized written plan that lays out the steps needed to help accomplish those goals, as well as an implementation timeline.

What You Need to Know About Social Security

Watch Our Video

How Can Pathway Help Simplify Your Life?

We make things simpler by bringing every part of your financial life together in one place. With one plan, guided by one primary advisor, you get a clear, coordinated strategy that keeps everything working in sync.

Financial Planning

Financial planning helps you manage all aspects of your financial life with one comprehensive plan. And at Pathway Financial Design, we help you manage it all with one point of contact.

- Retirement Planning

- College Planning

- Money Management

- Investing

- Protection Planning, Insurance

- Wealth Transfer Planning, Estate Planning

- Tax Services and Planning

- Charitable Giving Plans

- Divorce Settlement Planning

- Profit Sharing Plans

- Executive Compensation

6 Areas of Financial Planning

Download Now!

Investments

Investing and wealth management encompasses your invested assets and retirement savings, seeking opportunities for growth while hedging against stock market volatility.

- IRAs (Roth and Traditional Individual Retirement Accounts)

- 401(k) Rollovers

- Brokerage Accounts

- Managed Accounts

- 401(k)s

- 403(b)s

- College Savings Plans, 529 Plans

- Fixed, Fixed Indexed, and Variable Annuities

- Small Business Retirement Plans

Insurance

Insurance coverage helps manage risks that can impact your financial wellbeing. Don’t let an unexpected life event negatively affect your financial life—let’s talk about insurance.

- Life Insurance

- Medicare Plans

- Long-Term Care Insurance

- Disability Income Insurance

- Key Person Insurance